the accounting stuff

ACCOUNTING & finance Basics

Step 1: know the terminology. Download the Accounting Terms To Know worksheet!

SET UP YOUR BUSINESS ACCOUNTS

A business checking account and a business credit card are going to help you keep your work and personal finances separate. Depending on what bank you usually work with, look into what options they have to start a business account. Some banks will offer you bonuses depending on how much and how quickly you deposit in the account in the beginning.

Why do I need to do this?

Opening your business account is the best way to avoid mixing your personal expenses with your business expenses! With these separate, it’s easier to track your expenses, revenue, and makes tax season much easier. We recommend opening up a business checking account to get started then beginning your business savings account and/or business tax savings account. A savings account can boost your business credit, earn interest, and help you maintain minimum balance requirements.

Okay, I’m convinced…now how do I go about it?

Shop around for the bank and cards that are right for you

Always compare fee structures!

Everything is negotiable.

Combination of CC’s and banking accounts - ideal: Checking, Savings, and CC.

Open your business checking account

This is where many entrepreneurs choose to pay their expenses from, unless they are using a credit card.

Open your business savings account

A savings account will organize funds and plan for taxes

Consider a business credit card

Credit is important for your business to secure funding!

CREATE YOUR OWN ACCOUNTING PROCESS & ALWAYS TRACK YOUR EXPENSES

The foundation of building a solid business is accurate expense tracking. We track expenses to:

Monitor growth

Build financial statements

Keep track of deductible expenses

Prepare tax returns

Legitimize your filings

Types of receipts to pay special attention to-:

Out of town business travel

Transportation expenses

Home office receipts

ASK YOUR ACCOUNTANT ABOUT SALES TAX

Depending on the types of services, products, etc. you provide, you may be liable to remit sales tax to the government. What is “remitting” sales tax? If sales tax needs to be charged on a product or service, the sales tax must somehow make it’s way to the government. Talk to your accountant or a Sales Tax Accounting specialist to see if you need to register for taxes with your state’s office of tax and revenue.

Custom Clothing Stylists: If you sell custom clothing, you will need to remit your own sales tax! The profits you make on custom clothing are not the same as commissions that we pay you from our partners. Make sure to coordinate with your accountant to remit the sales tax you collect from any products you’ve marked up each month.

Examples of things you do NOT need to remit sales tax for:

Style Boxes, In-Person Appointments, and Pulls via Garmentier (this is part of why we built this platform - we make it easier on you!)

WHO & what TO HAVE IN YOUR AMMO

BOOKKEEPER/ACCOUNTANT

Hiring a Bookkeeper is a great way to save time so you can focus on styling and growing your business! It is possible that you may need a separate sales tax professional from your accountant. We have great recommendations for you on a few preferred partners if you’d like!

We love…

Marguerite Pressley Davis

Business Management Consultant

Linda Karressy

Founder, Insight Financial Group

BUSINESS REGISTRATIONS & SALES TAX PROFESSIONALS

If you’re liable to remit sales tax on behalf of your business, you’ll need to have certain business permits. Ask your lawyer, accountant. or simply consult platforms like LegalZoom to see what you need.

BUSINESS INSURANCE - YAY OR NAY?

Business insurance is something to consider, but is not very common for small businesses in personal shopping and styling. Why, you may ask? The minimum amount you can claim is $5,000, which is rare to ever have to claim - and the premiums typically aren’t worth it. Take a moment to research your options and talk to your local friends in insurance - if you need a recommendation, we’ve got you!

Utilizing Garmentier’s accounting tools

At the core of Garmentier is our accounting and invoicing tools with a mission to make keeping track of your business easy so you can spend less time doing administrative work. With Garmentier you can bill your clients for anything from clothing that they purchase to your styling services and anything else you need to charge them for!

THE ACCOUNTING REPORT

Each invoice that you charge your clients for will show up in your accounting report. To view select Accounting on your Garmentier Dashboard.

Views:

By Order: Transactions displayed by date or searchable by zip code

By Payout: Transactions displayed in groups to show which orders were deposited together, and when

ACCOUNTING REPORT DEFINITIONS

Date - Date of Transaction

Description - Garmentier Invoice #

Stylist - Stylist that processed charge

Client - Client

Style Box R2W - $ amount of Style Box merchandise purchased

Custom - Custom subtotal

Services - Styling Services charge amount

Tailoring - Tailoring charge amount

Shipping - Shipping charge amount

Misc - Miscellaneous charge amount

Taxable Subtotal - Total dollar value on invoice that is subject to tax

Zip Code - Client's billing zipcode

Sales Tax % - Sales tax percentage based on your business location set in Company Settings

Sales Tax ($) - Dollar amount of Sales Tax collected

CC Processing - Credit Card processing fee amount

Waive/(Charged to Stylist) - Yes/No : Did you waive the CC Fee or charge it to your client?

Invoice Total: Total dollar amount charged, including taxes and CC fees.

R2W COGS - Ready to Wear “Cost of Goods Sold”

Custom COGS - Custom “Cost of Goods Sold”

Commission: Commissionable amount earned (Garmentier partners only)

Profit: Your take-home profit from the transaction

Net Deposit: What will actually be deposited in your account

Payout Date: When this invoice’s net deposit amount will hit your bank account

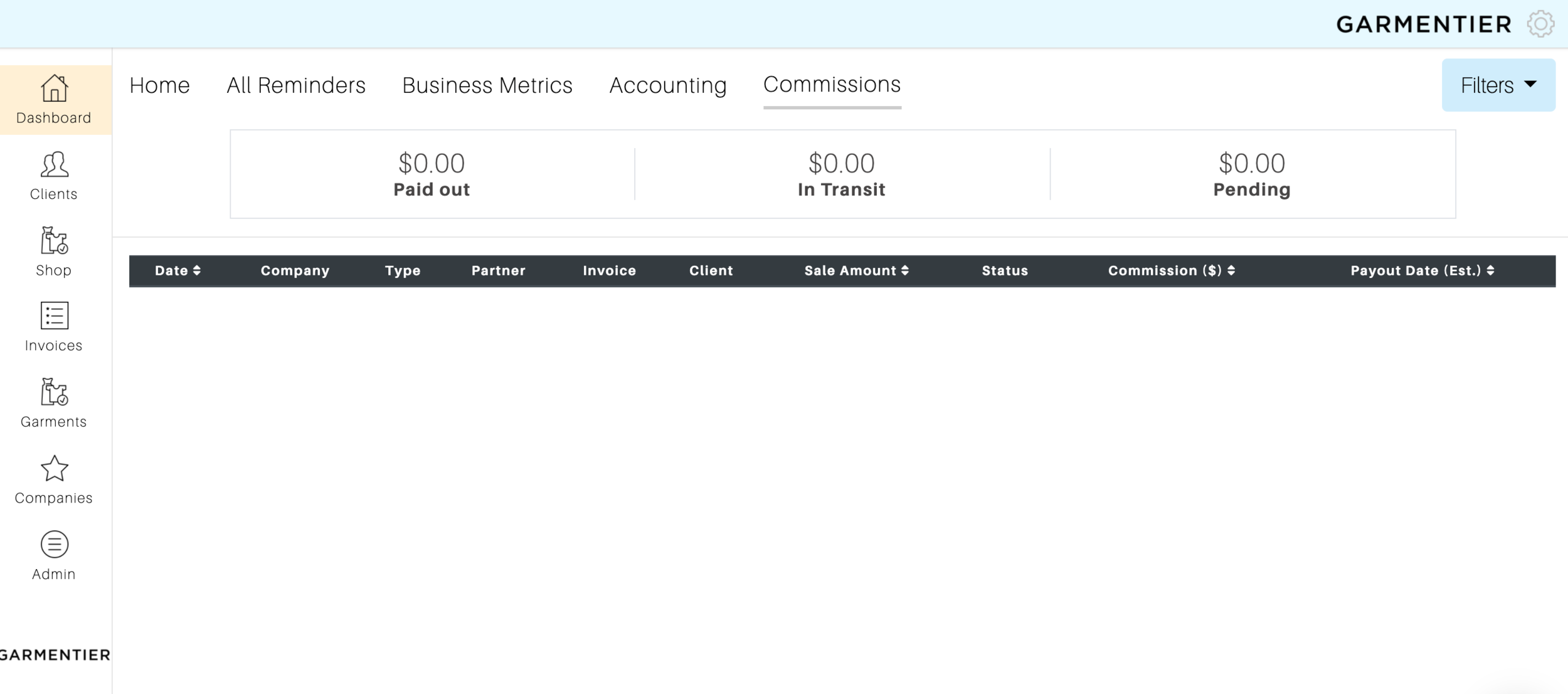

COMMISSIONS REPORT VS THE ACCOUNTING REPORTS: WHAT’S THE DIFFERNCE?

From your Garmentier Dashboard, select Commissions to track your commissions and pay-out statuses! You’ll see what commissions are paid out, pending, or in transit.

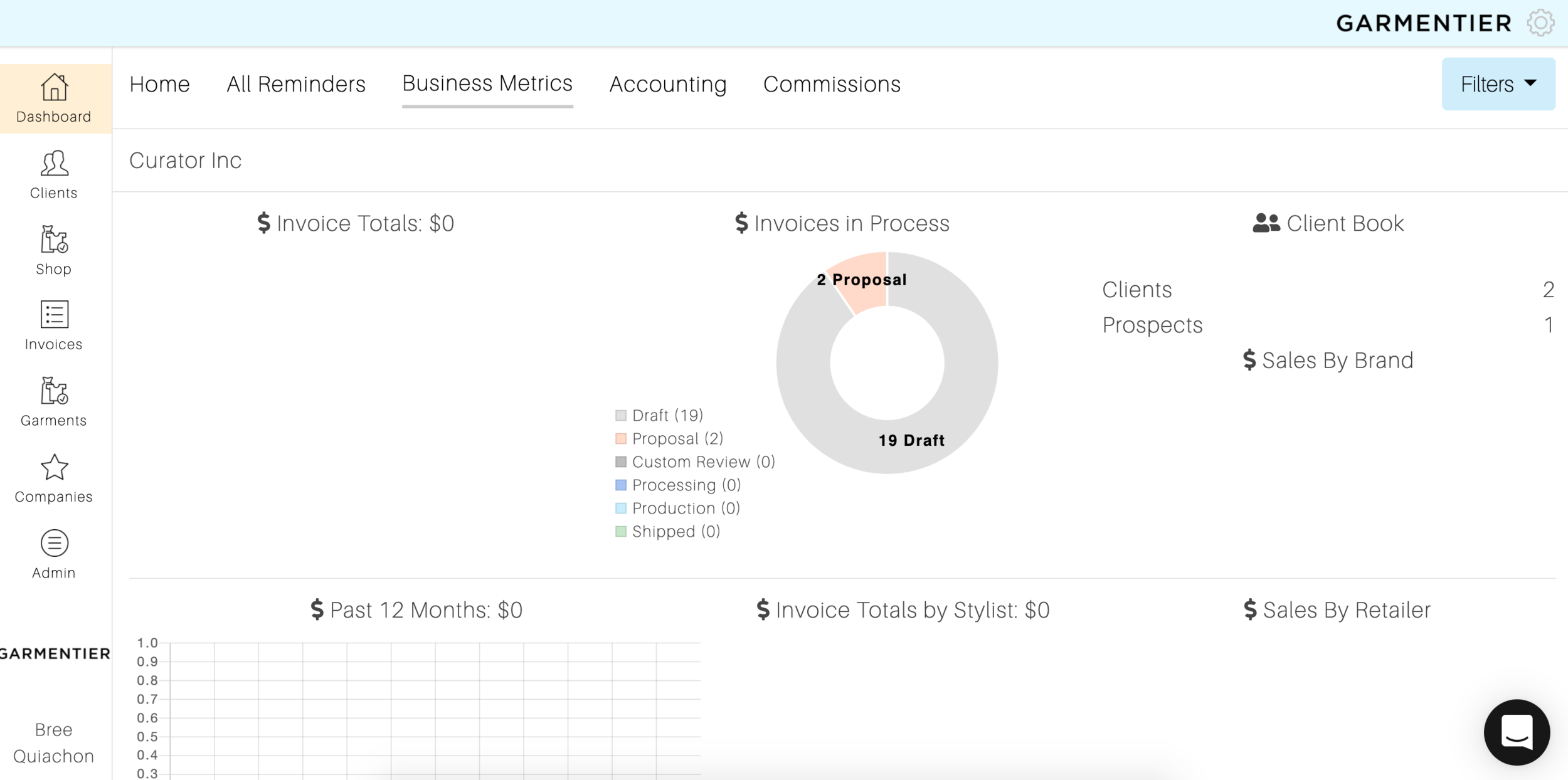

USING GARMENTIER’S BUSINESS METRICS DASHBOARD

From your Dashboard in Garmentier, select Business Metrics to track your invoices. You’ll see your invoices in all stages of the process and total sales amounts!

SALES TYPES:

Each of these require different accounting practices based on the state you’re in.